There are several questions that hopeful retirees are consistently asking as they seek to build a successful retirement. Some of these questions are:

- When can I retire?

- How much do we need?

- Will I have enough?

- What if there’s a major healthcare, stock market, or inflationary event that threatens what we’ve saved?

While all of these questions are certainly different from one another, they are largely variations on the same theme.

Essentially, the process of addressing these concerns requires converting one’s pile of money into an income that lasts as long as they do. When we can do that successfully, the risk factors can be managed quite well. But how do we do it? Put more bluntly: “Adam, how do you know that this plan will work?”

When it comes to retirement income planning, there are a number of approaches. While I won’t go into great depth here, you can choose to read my retirement income planning series I wrote for LifeHealthPro and Retirement Advisor Magazine here, here, here, and here. Yes, it’s a four-article series that addresses each retirement income planning method. (Caution: not for the feint of heart)[vc_row padding_top=”10px” padding_bottom=”10px” border=”none” bg_color=”#eaeaea”][vc_column width=”1/1″]

There are two distinct approaches in retirement income planning: probability-based and guaranteed.

Probability-Based Retirement Income Planning

The first relies on historical market performance and extrapolates those returns and offers a statistical probability of future success. For Detroit Tigers fans, consider that Miguel Cabrera may have a batting average of .320, allowing you to run the numbers and expect that trend to continue into the future. Yes, there’s a 68% chance that he’ll not find success at the plate, and injury, illness, and an occasional slump may contribute further to some tough days for Tigers fans, but you can expect Miguel to perform comparatively well given his history.

Not unlike a hitter in baseball, the stock and bond markets can be counted on to deliver future performance that is quite similar to past performance, but – and repeat after me – past performance is no guarantee of future results. When things go well, they can go really well. When the market stumbles, however, a retiree’s ability to draw the necessary amount of income from a probability-based stocks and bonds portfolio can result in real failure. As defined in income planning terms, that means the money runs out before you were ready for it to do so.

Guaranteed Income Planning

For those who appreciate a sure thing, and sleep better at night when not reliant on finicky and volatile stock and bond markets, there is a way to have your cake and eat it too. The answer is to get you and your closest thousands of friends together and agree that some of you will live longer than expected, while others will fall short of a very long life. As such, you pool your money together and agree to make sure everybody receives an income for life, regardless of how long each person lives. The tradeoff? Some people get a little more than their fair share and others only get their fair share.

This arrangement, of course, involves highly-regulated insurance companies, very long-term investment portfolios, more cash reserves set aside than obligations created, something called reinsurance, and a state-run guaranty fund that ensures the whole thing pays out without the risk of going it alone in the stock and bond markets.

By converting the appropriate portion of your pile of retirement money to this arrangement, a stream of payment checks arrives in your bank account each month for the rest of your life, guaranteed. The rest of the money you may have set aside is able to live in the finicky and volatile stock and bond markets described above. Since these markets often provide long-term growth, that means you’ll allow yourself the means with which to manage a health care event, inflationary era, and occasional market drops…all while enjoying a retirement income that lasts for the entire life of you and your spouse.

Synergy, In Summary

When approaching retirement, income planning is where it all starts. It’s on this foundation that all else is built. With the right architect, a clear blueprint, and materials that will stand the test of time against the elements, you create for yourself a fiscal house that allows you to get to the most from your money and the best for your life.

See, when we embrace the risks and anticipate them, we allow a sort of double vision to occur. We can protect what’s needed and prosper to achieve what’s wanted. I call it synergy, you can call it what you’d like. Simply put, it’s retirement planning done well and you deserve no less.

All the best,

Adam Cufr, RICP®

Discovery Sessions

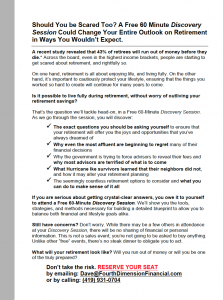

You may have heard that we’re beginning to offer something called Discovery Sessions. What is a Discovery Session? Well, I’m glad you asked. It is a free 60-minute experience designed to help people learn the tools, strategies, and methods necessary for building a detailed blueprint to allow them to balance both financial and lifestyle goals alike.

Designed for people new to Fourth Dimension, attending one of these no-obligation sessions gives them the opportunity to learn, for themselves, what they want their retirement to look like and the options to consider when designing their plan. It’s a really thought-provoking process and we would love it if you were to introduce the session to friends who may be considering their retirement options.

Please click here to view a detailed flyer that you can share with a friend.

Upcoming Session:

Upcoming Session:

Thursday, June 18th at 5:30 P.M.

There are a number of ways to RSVP. Call us at (419) 931-0704 or email: Dave@FourthDimensionFinancial.com.

If you’d like a ready-prepared email to send to friends, email us and we’ll send it your way.

Thanks so much for your help in alerting others to the options available to them. It means so much to us and them when you make a connection.

Recent Articles

Show Your Work: Why Transparency Matters in Retirement Planning

Unlocking the Mystery of Income Taxes

Social Security Strategy: Do You Have One?

Pension Decision: Just One Critical Piece of Information Is Needed to Decide