I’ve avoided writing about the election as long as I can; not because it’s not important, but because it’s political, and impossible to accurately predict such things. However, this is a huge election and the consequences to you and your financial security are on the line. So, here goes.

Here’s the big question: How will the markets react if _______ is elected?

Here’s the big answer: I don’t know.

Have a great weekend! Please let us know if you have any quest…….

Oh, you want more? Alright, alright. There are many ways to approach this. One approach I refuse to take is the fear mongering method. So much of this election cycle has been predicated upon fear. If you elect him or if you elect her, the world as you know it will cease to exist. That may or may not be true, but it’s a poor foundation for prudent decision-making for your financial matters.

As for the stock market, there are so many reasons for a possible market decline in the next year or two (interest rates, 8 years since the last huge decline, ObamaCare premium increases, cyberwar, China’s economic slowdown, BREXIT, we’re-bored-so-we-need-a-big-shakeup, etc.) that trying to make a prediction based on one branch of the government in an economy this large is a tough call. Meanwhile, we’ve seen market growth despite all of that craziness.

When I need a logical, pragmatic approach to financial markets, I reach out to my friend and colleague, Stephen Hanley. He’s an Investment Strategist that I’ll formally introduce you to in the near future. Until then, here is his response to the big question:

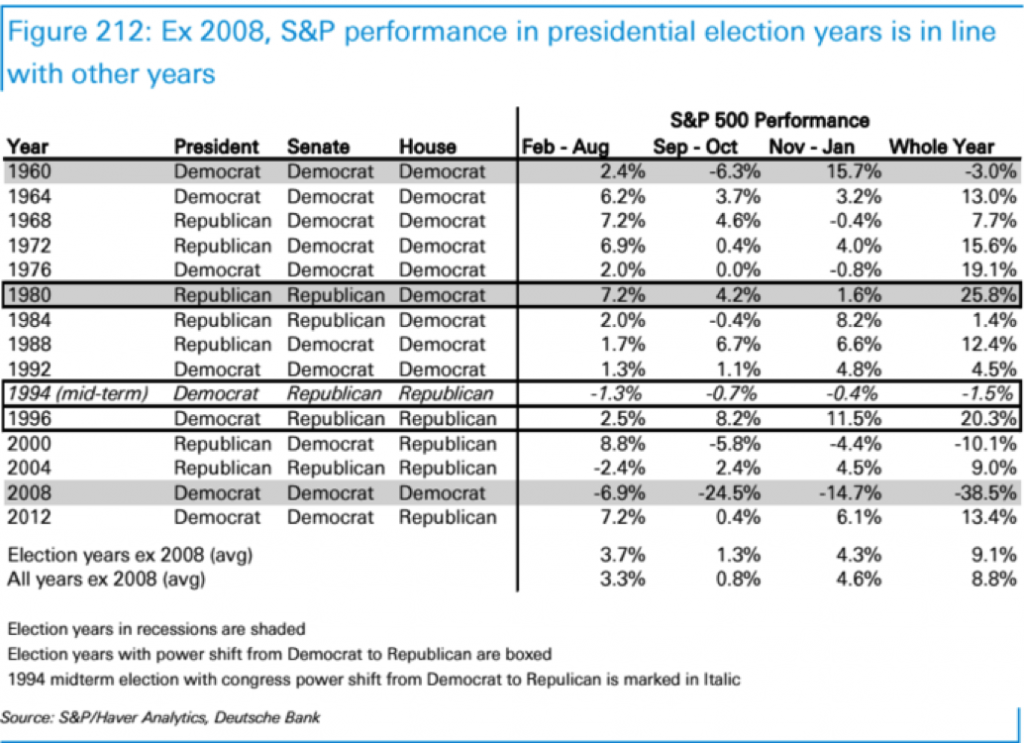

“I can only go on statistics and facts:”

Takeaways:

1. Election years are usually not ‘bad,’ and certainly not any worse than the random short-term nature of the market.

2. 2008 was unique and we do not have those same issues currently.

3. Generally, we see good results in November and December as the election uncertainty is removed from the market and we find out who is elected. Regardless of who wins, removal of uncertainty helps investors and the markets.

4. In 16 of 17 election cycles, the November-January months have produced a range of –4% to 15.7% returns, which is nothing to fear. Again, 2008 was the only unique circumstance and not because of the election.

5. In 12 of 17 cycles, the market has been positive November-January after the election.

So the data, while still statistically insignificant, is skewed toward more positive results during presidential election cycles. This is logical since less uncertainty will remain, allowing investors to make more fact-based decisions.

So as you can see, Steve views the investing world though a very logic-based lens. From this, I hope it helps to answer your question. In a nutshell, markets seem to take presidential elections in stride (statistically), even though the short-term uncertainty makes things appear very uneasy. That said, a Trump presidency might prove that this really is no normal election. That said, a Clinton presidency might prove that this election really is no normal election. We shall see.

When it comes to your personal retirement planning, ensure that you have the appropriate amount of your retirement income secured, either through guaranteed annuities or a combination of dividend-paying stocks and high-quality bonds. If you’re not confident in this area, then you’re risking the foundation of your retirement and financial security. Once that foundation is in-place, reaffirm the amount of risk you’re taking with your discretionary investments. These are the fundamentals we need to lock-in.

What we wake up to on November 9th will go a long way toward reducing the uncertainties that the stock market dislikes so much. The result may not be what you or I would prefer, but the market will finally have an opportunity to price in the results of the election, so we can move forward.

Please let us know how we can help you secure your foundation. Let’s get out there and vote, but not before filling our bags with a little (or a LOT of) Halloween candy.

All the best,

Adam Cufr, RICP®

Recent Articles

Show Your Work: Why Transparency Matters in Retirement Planning

Unlocking the Mystery of Income Taxes

Social Security Strategy: Do You Have One?

Pension Decision: Just One Critical Piece of Information Is Needed to Decide