So much has changed in the past three or four decades when it comes to retirement. For one, there was a time when you worked at one company your entire career, then retired with a gold watch and a lifetime pension. While many of our clients still have a company pension, “they ain’t what they used to be,” as the saying goes.

When companies learned that they could outsource the burden of retirement planning to you, the employee, they didn’t hesitate to act. As a result, we have the 401(k) where we once had guaranteed income pensions. The 401(k) can be a very powerful wealth building tool, we just need to know how to convert it – or a portion of it – back to a form of personal family pension at retirement to provide that lifetime income we all aspire to have.

So what’s my beef with the 401(k)? Why do I suggest that it’s deceiving you? Allow me to explain. During your working years, you chose to diligently fund your 401(k) with a portion of each paycheck (Well done!). Week after week, year after year, decade after decade, you added money to your nest egg. Meanwhile, the stock and bond markets swayed up and down, creating a squiggly line that trended up nicely over the years. But when you looked at your 401(k) statements, the flow of new money being added to your account made the effect of that squiggly line of performance much more muted during the down times and much more dramatic during the up times.

In other words, your 401(k) deceived you by making you feel as if it was performing better than it was, thanks to the effect of your new money always being added. Where this becomes a bit of a problem is during retirement. The investment accounts that you own during retirement don’t have the benefit of new money flowing in. The result is many retirees becoming frustrated when the market experiences seasons of little growth or loss.

Astute readers will point out that the new money added to the 401(k) doesn’t actually alter the returns of the underlying investments themselves, but it sure feels that way. This experience creates a new psychological hurdle to be overcome for the new retiree. Retirees, therefore, need to become comfortable with account values that don’t always go up from week-to-week as they appeared to do when the money was in the 401(k).

In a nutshell, the relationship you had with your money during your working years must change a bit when retirement arrives. Your money is working just as hard for you as it always was, it just has a new job now. Its job is to sustain you for the rest of your life. This job is not one that should be assigned to the wild, swinging stocks of youth, but instead to the dutiful, hardworking income solutions available to those who need a pension-like retirement without the benefit of a company pension.

This observation may be one of the more subtle I’ve asked you to consider, so allow me to be more direct as I wrap up. Your financial approach during retirement is supposed to be much different than your approach leading up to retirement. If it feels weird, it should….at least for a while. You’ll be just fine once you embrace the weirdness and lean into it.

All the best,

Adam Cufr, RICP®

P.S. I’ve been receiving some really great feedback from these weekly emails, especially the one where I described what I do all day. I didn’t see that coming 😉 Always feel free to hit the reply button and tell me what you’re thinking. Also, please let me know what topics you’d like to hear more about. I love hearing from you!

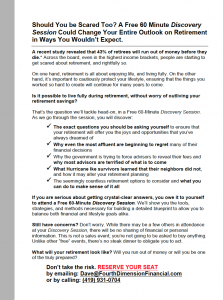

Discovery Sessions

You may have heard that we’re beginning to offer something called Discovery Sessions. What is a Discovery Session? Well, I’m glad you asked. It is a free 60-minute experience designed to help people learn the tools, strategies, and methods necessary for building a detailed blueprint to allow them to balance both financial and lifestyle goals alike.

Designed for people new to Fourth Dimension, attending one of these no-obligation sessions gives them the opportunity to learn, for themselves, what they want their retirement to look like and the options to consider when designing their plan. It’s a really thought-provoking process and we would love it if you were to introduce the session to friends who may be considering their retirement options.

Please click here to view a detailed flyer that you can share with a friend.

Upcoming Session:

Upcoming Session:

Thursday, July 2nd at 5:30 P.M.

Thursday, July 16th at 5:30 P.M.

There are a number of ways to RSVP. Call us at (419) 931-0704 or email: Dave@FourthDimensionFinancial.com.

If you’d like a ready-prepared email to send to friends, email us and we’ll send it your way.

Thanks so much for your help in alerting others to the options available to them. It means so much to us and them when you make a connection.

Recent Articles

Show Your Work: Why Transparency Matters in Retirement Planning

Unlocking the Mystery of Income Taxes

Social Security Strategy: Do You Have One?

Pension Decision: Just One Critical Piece of Information Is Needed to Decide