Do you know one of those people who seem to hit every green light on the boulevard of life? Everything they touch seems to work out exceedingly well? If so, they’re the person who’s likely to have retired in a year like 1991. Why? For one, the stock market began its almost-unbelievable rise through the 1990s, replenishing their retirement nest egg much faster than they could spend the money.

One of the most interesting, and potentially devastating, factors in retirement planning is the effect of something called ‘sequence of returns risk.’ In a February 27, 2014 CNN Money article titled: “Plan For the Critical First Decade of Retirement” authors Donna Rosato and Penelope Wang wrote:

“The idea is called sequence risk: After you retire and start drawing on your savings, it’s not just the long-term average rate of return that matters. The order in which those returns arrive is crucial. Retire near the start of a bear market or even just a long period of mediocre returns, and the effect of withdrawing dollars from a shrinking or stagnant portfolio is that you won’t have as much to gain from a rebound.”

So your friend, who may have retired in 1991, did very, very well. On the other hand, retiring in 2000 would have been comparatively devastating. The same rate of income withdrawals would have depleted the same starting investment portfolio decades sooner.

What can you do to combat sequence of returns risk? Simply retire at the right time – that’s it! Seriously, this is the trouble with retirement planning. If you can tell me, in advance, how well the market will perform, and how long you’ll live, this would be a pretty easy job, retirement planning. But you can’t, so it’s not.

Given the tremendous market returns we’ve seen since the devastation of 2008, one should wonder: “Where are we now, in terms of the market?” In other words, is this a 1991 time to retire or a 2000 time? While neither you nor I know the answer to that question, we can plan accordingly so that either scenario is a successful one. Build your plan right and you’ll profit when the market grows in 1990s fashion, while protecting yourself when the market feels like carrying on with 2000s-era shenanigans.

Like any successful sports team, games are won consistently when both the offense and defense are performing well. So in retirement, play to win by ensuring you’re playing strong performers on both sides of the ball.

We don’t need to have the Midas touch like your friend to win in retirement. We simply need to decide to prepare for 2000 and 1991, bear markets and bulls, alike. The peace you experience when you’ve done that? That’s what a successful retirement feels like.

All the best,

Adam Cufr, RICP®

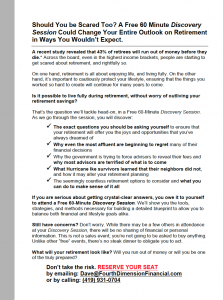

Discovery Sessions

You may have heard that we’re beginning to offer something called Discovery Sessions. What is a Discovery Session? Well, I’m glad you asked. It is a free 60-minute experience designed to help people learn the tools, strategies, and methods necessary for building a detailed blueprint to allow them to balance both financial and lifestyle goals alike.

Designed for people new to Fourth Dimension, attending one of these no-obligation sessions gives them the opportunity to learn, for themselves, what they want their retirement to look like and the options to consider when designing their plan. It’s a really thought-provoking process and we would love it if you were to introduce the session to friends who may be considering their retirement options.

Please click here to view a detailed flyer that you can share with a friend.

Upcoming Session:

Upcoming Session:

Thursday, July 16th at 5:30 P.M.

There are a number of ways to RSVP. Call us at (419) 931-0704 or email: Dave@FourthDimensionFinancial.com.

If you’d like a ready-prepared email to send to friends, email us and we’ll send it your way.

Thanks so much for your help in alerting others to the options available to them. It means so much to us and them when you make a connection.

Recent Articles

Show Your Work: Why Transparency Matters in Retirement Planning

Unlocking the Mystery of Income Taxes

Social Security Strategy: Do You Have One?

Pension Decision: Just One Critical Piece of Information Is Needed to Decide